In Thailand, “cannabis” has been an interesting subject over the past few years and there are still debates inherited from different opinions until researches have been active in the field of medical study, legalizing the use of cannabis for medical purposes in Thailand as the first country in ASEAN. Moreover, in the business sector, companies started taking an interest in using cannabis as an ingredient or material for their products 1-2 years ago.

Although, “cannabis” became legal in Thailand, the feedback loops come in two sides: positive and negative. It is therefore interesting to learn about the views and attitudes of the Thai society towards such trends.

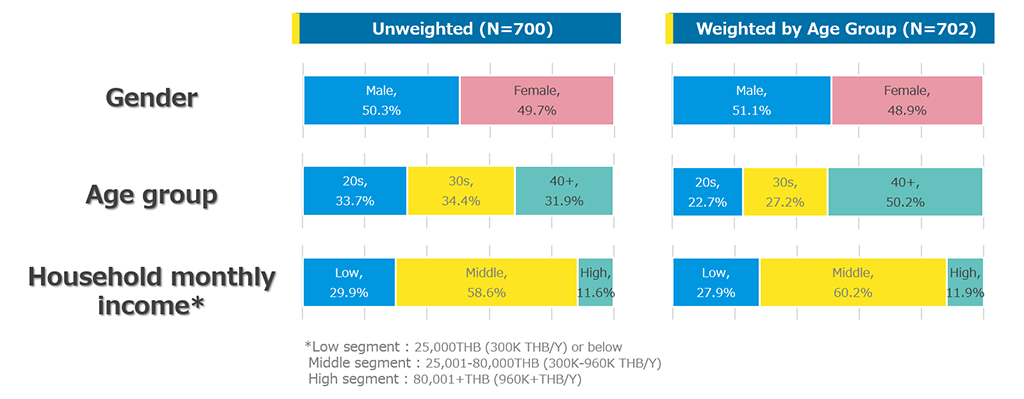

In order to understand the cannabis market, Nikkei Research & Consulting (Thailand) has conducted an independent study in Thailand, using an online-based quantitative survey with 700 respondents including males and females aged between 20 – 59 years old.

Perceptions and attitudes of “Cannabis” use

Looking at the results, male respondents have more positive attitude towards cannabis than female ones. All respondents’ perceived cannabis as; 1) an economic benefit (63.2%) where some thought that cannabis could light up the economic engine and generate income for Thailand; 2) medical use for treatment (61.8%) and 3) health benefits (55.9%). Most are health-related, possibly due to the fact that cannabis benefits have been widely discussed over time. In addition, the results of the study show that people aged 30 and over tend to agree with the fact that cannabis provides an economic benefit and they would need to try it for medical treatment.

Expectations arise as Cannabis was legalized

The study has expressed that 70% of the respondents are positive about cannabis products, where 7 out of 10 respondents would like to try them within the legal range. In turn, the rest of respondents (3 out of 10) who refused to try cannabis products would change their mind when they received word of mouth (WOM) from friends and relatives. However, where there are interests, there are of course some expectations. The most expected effect from cannabis is stress relief (32.6%), pain relief (20.6%), deeper sleep (14.2%). As you can see, the expectation of using cannabis product is associated with tackling the physical and mental health issues, reflecting the above-mentioned perceptions and attitudes. Male respondents would expect the stress relief benefit more than female respondents whereas female respondents would expect the pain relief benefit more.

Identified opportunities for cannabis products

According to this survey, in the Thai market, dietary supplements (44.0%) are the most preferred form of cannabis products, followed by cannabis tea, also known as weed tea (33.8%) and body care products (33.4%) eg. body oil/lotion/cream. The results further revealed respondents were expecting to see the development of cannabis products in the food rather than cosmetic industries.

Nevertheless, looking at the cosmetic industry alone, more than 50% those who showed their interest, would like to use some cannabis cosmetic in their everyday life eg. soap/shower gel/ toothpaste. It is worth noted here usage frequency by inedible cannabis goods. People would still use them like others of their daily products.

In order to achieve the objective of cannabis market growth, we should be aware of the consumer’s needs which we have found in this study.

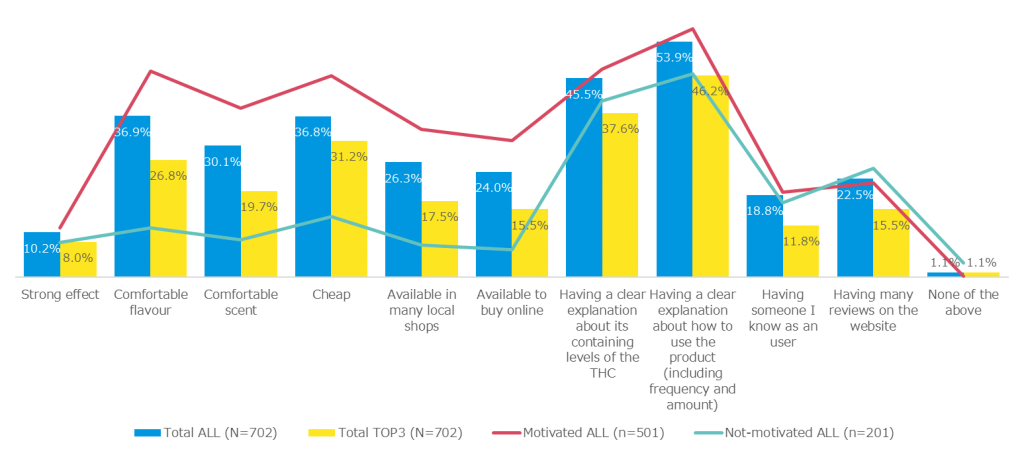

The most important thing to be concerned for business is to provide a clear usage instruction including frequency and amount (53.9%) a clear explanation of Tetrahydrocannabinol (THC) level (45.5%). In addition, the products need to come up with pleasant flavor (36.9%) and inexpensive price (36.8%). These are the most attractive factors that could motivate Thai consumers and encourage them to try cannabis products.

Increasing the perception of “Cannabis”

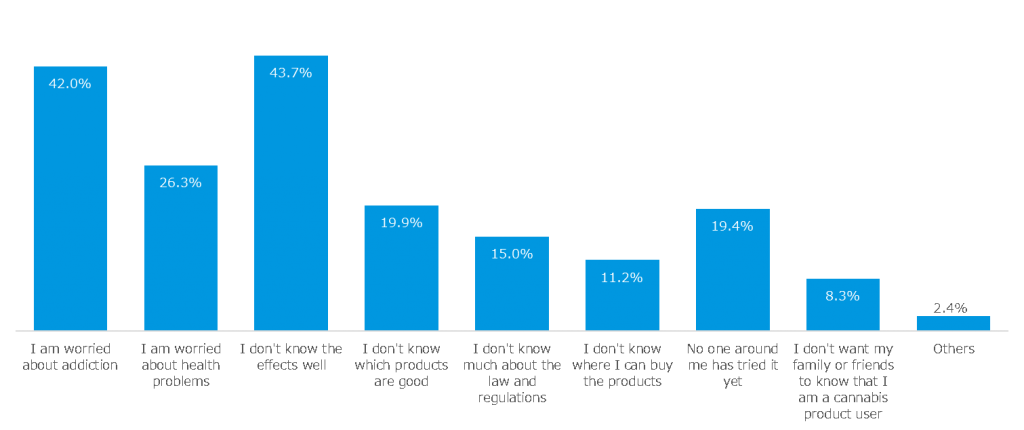

There is no denying that many Thai people are still conservative, implying that they are not easily open to changes. This could be one of the major reasons why they would not think of trying or using cannabis products even though cannabis use is legalized. To further prove this statement, this study reveals that the main reason why respondents do not want to try cannabis products is a lack of knowledge about the impacts of cannabis (43.7%), concern about addiction (42.0%), and concern about health problems (26.3%). These reasons reflect the lack of information and abundance of misinformation, which lead to low confidence level of consumers towards cannabis products. As a result, communication is a crucial factor that must not be overlooked, and the message should be directed towards market education relating to cannabis extracts, together with enhancing usage confidence especially in terms of safety and side effects. All these should be key influencing factors in changing the consumers’ attitudes towards cannabis products in the future.

In conclusion, to make cannabis products more acceptable in the Thai market, it is a challenging task for all stakeholders. Not only should the manufacturers focus on product development, but other relating businesses should also plan and coordinate with one another in several dimensions in order to build consumer’s confidence and enhance the various benefits of cannabis, which would contribute to the growth in the long run.

For further details about the cannabis market and trends to create opportunities, please visit our websites and feel free to contact us for a more detailed discussion. At Nikkei Research & Consulting, we offer full services, custom-tailored and marketing research services, including connecting advanced technology and innovation work style.